Unlock Your Solar Savings

Your investment in solar energy opens the door to a range of enticing federal, state, and local incentives, making it not just a smart choice but an incredibly rewarding financial decision!

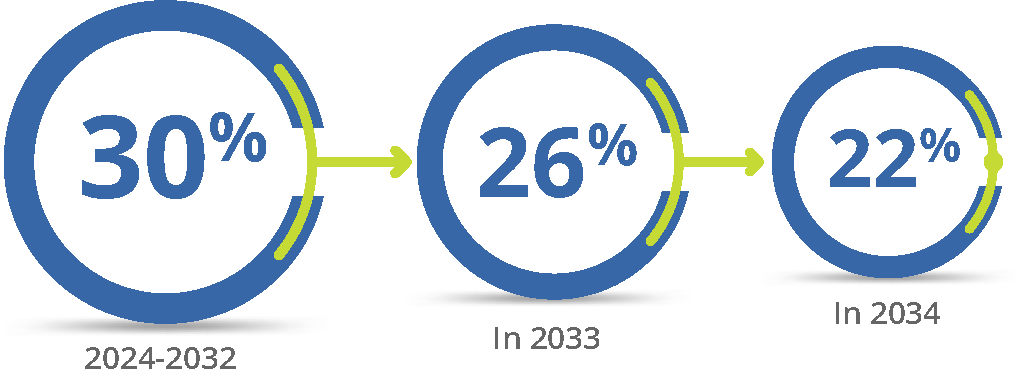

Federal Investment Tax Credit – 30%

The solar investment tax credit (ITC) is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The federal ITC is based on 30% of the homeowner’s cost to install solar from 2024 to 2032. On leased systems, Suncovia collects this incentive and passes the savings on to the homeowner. Don’t wait; prices for solar equipment are on the rise!

State Incentives

- Net Metering

- Description: Earn credits for excess solar energy sent back to the grid. These credits can offset future energy costs, leading to significant savings.

- Property Tax Exemption

- Description: Solar installations are exempt from property tax increases, meaning the added value of your solar system won’t affect your property taxes.

- Sales Tax Exemption

- Description: Homeowners benefit from a sales tax exemption on solar equipment, reducing upfront costs by eliminating state sales taxes from solar system purchases.

- Renewable Energy Fund (REF) Rebate

- Benefit: Offers $0.20 per watt of solar capacity installed, up to a maximum of $1,000 or 30% of the system cost, whichever is lower.

Description: Offers rebates for residential solar systems to further lower installation costs.

- Net Metering

- Description: Receive bill credits for excess energy produced by your solar panels, helping to lower your utility bills.

- Solar Massachusetts Renewable Target (SMART) Program

- Benefit: Offers fixed payments (incentives) for the electricity produced by solar systems, includes additional incentives for energy storage systems.

- Mass Solar Loan Program Benefit:

- Benefit: Provides low-interest loans to Massachusetts homeowners to help finance solar energy systems.

- Net Metering

- Description: Receive bill credits for excess energy produced by your solar panels, helping to lower your utility bills.

- Renewable Energy Fund (REF) Rebate

- Benefit: Offers $0.20 per watt of solar capacity installed, up to a maximum of $1,000 or 30% of the system cost, whichever is lower.

Increase Home Value

Having a residential solar energy system on your property is known as a capital improvement, which adds to your property’s value. This means that you can potentially sell your home faster and for more than homes without solar. Your investment in efficient, clean solar power also adds to the tax basis of your home. If you sell the home, this tax-based investment can be deducted from the sale’s price, reducing the amount of the price that is counted as profit. This reduces the taxes taken from the sale and may be able to help you avoid capital gains taxes on appreciation.