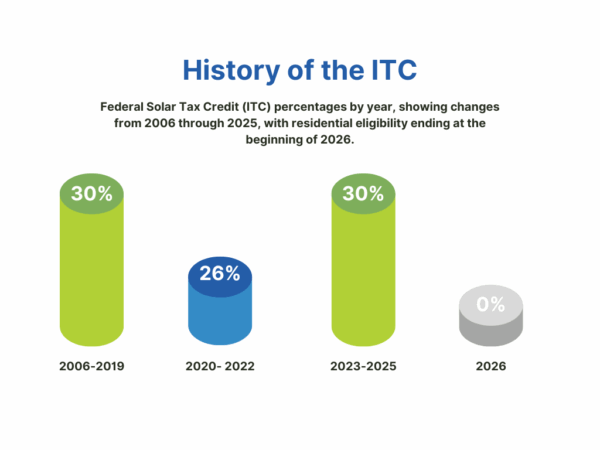

Federal Solar Tax Credit (ITC) Ends in 2025: What Connecticut, Maine, New Hampshire, and Massachusetts Homeowners Need to Know

In July 2025, new legislation ended the 30% Federal Solar Tax Credit, also known as the Investment Tax Credit (ITC), seven years earlier than expected. It now expires on December 31, 2025, instead of 2032.

Bar chart showing the history of the Federal Solar Tax Credit (ITC) from 2006 to 2026. Credit was 30% from 2006–2019, dropped to 26% for 2020–2022, returned to 30% for 2023–2025, and ends at 0% for residential in 2026.

If you live in Connecticut, Maine, New Hampshire, or Massachusetts and want to benefit from the ITC, your solar system must be fully installed by the end of 2025.

What Is the Federal Solar Tax Credit?

The Federal Solar Tax Credit (Investment Tax Credit or ITC) lets eligible homeowners deduct 30% of the total cost of a solar energy system from their federal taxes. That includes equipment, installation, permits, and even battery storage.

This credit has helped make solar more affordable for years by reducing upfront costs. But now, time is running out.

Who Can Qualify?

Homeowners may qualify for the ITC if they meet the following:

-

Purchase or finance their solar system (leasing doesn’t qualify)

-

Own the home where the solar is installed

-

Complete installation and activation by December 31, 2025

-

Owe federal taxes to apply the credit toward

Why You Should Act Now

Solar projects typically take 60 to 90 days to complete. To get the 30% ITC, your system must be active before the end of 2025.

If you wait too long, you risk missing the deadline — even if your contract is signed. New England is seeing a surge in demand. Permitting delays and full installation calendars could slow things down.

How Suncovia Helps You Claim the Solar Tax Credit

Suncovia is a full-service solar provider serving Connecticut, Maine, New Hampshire, and Massachusetts. Our experienced in-house team manages every step — from consultation to installation.

We don’t outsource. That means better quality control, fewer delays, and a smoother process to help you meet the federal deadline.

Here’s what sets Suncovia apart:

-

Local Expertise – We understand New England’s unique regulations and utility processes

-

Full-Service Installation – We handle design, permitting, and all coordination

-

Clear Ownership Options – We offer financing that ensures you own the system and qualify for the tax credit

-

Ongoing Support – From quote to activation, our team is here to guide you

Working with Suncovia means partnering with a company focused on your savings, long-term energy goals, and making solar accessible to every homeowner we serve.

The Federal Solar Tax Credit ends on December 31, 2025. This is your last chance to save thousands on solar installation. If you’re in Connecticut, Maine, New Hampshire, or Massachusetts, act now to secure your system and lock in your eligibility.

Get your free solar quote today and take advantage of the 30% tax credit before it disappears.

www.suncovia.com